Explaining Health Care Reform to Your Employees

Peter Freska, CEBS

Peter Freska, CEBS

Benefits Advisor

The LBL Group, A UBA Partner Firm

It is finally here. The Patient Protection and Affordable Care Act (PPACA), along with all the “stuff” that has been following it is really happening. Of course, with any major change there are bumps along the way. Apple had a bump with it new iOS7, and was able to respond and issue an update to fix the problems in short order. Perhaps the only difference is that Apple employees are still working… Okay, in fairness, so are the health care reform exchange employees.

So what about the employees of your company? The latest tracking polls from the Kaiser Family Foundation (source: http://kff.org/health-reform/) indicate that the public’s top two questions about health care reform are:

- How much will the law cost me and how is it paid for?

- What does the law do and how does it work?

With information coming at employees from all angles, it is hard to know what to believe, let alone what parts need to be understood. More and more, employers are looking to their trusted advisors to help answer their employees’ questions. With 49 percent of the United States receiving employer-based health coverage, looking to their employers is the obvious choice.

| Location | Employer | Individual | Medicaid | Medicare | Other Public | Uninsured | Total |

| United States | 49% | 5% | 16% | 13% | 1% | 16% | 100% |

Source: http://kff.org/other/state-indicator/total-population/

So as an employer, the question becomes how to respond. As with most things, communication, communication, communication is the key. Employers and employees need to communicate. And, if they don’t know the right answer both should look to their trusted advisor as the best educated resource to the right answer. Here are 10 tips from the International Foundation of Employee Benefits to assist with communicating the health care reform law to your employees.

- Explain ACA simply and concisely. The law and its regulatory guidance are far-reaching, complicated and lengthy. Stick to the basics when communicating with your participants.

- Focus on the most immediate changes. Cover what is happening during open enrollment and what changes are coming in 2014.

- Focus on the areas that most impact your workers.

- Clarify that your workers do NOT need to purchase health insurance through the public exchanges.(Most employers are maintaining their coverage. If you are dropping coverage for some or all of your employees, be explicit in the steps they need to take.)

- State the value of your health coverage in dollars per person. You may also include total cost spent by the organization or cost per payroll, but a worker will better appreciate and understand the value when positioned per individual rather than the organization’s perspective.

- Remind workers of the health care providers available through your plan.

- Inform workers of any existing or changing cost-sharing provisions. Clarify provisions such as deductibles, copayments, premiums, etc.

- Explain design changes to your plan due to ACA. Cover changes that may impact your workers including preventive services coverage and elimination of out-of-pocket maximums.

- Emphasize your company’s commitment to providing health care in the future.

- State why you offer benefits in the first place. Whether it is to attract the best talent, be competitive or to take care of workers, explain to your workers what you offer and why you offer it.

Source: http://www.ifebp.org/News/FeaturedTopics/HCRC/acahowto.htm

By Thomas Mangan

By Thomas Mangan

Mike Humphrey

Mike Humphrey

We’ve had a lot of employers request a simple, at-a-glance way to see all the PPACA requirements that apply to their business. This is no easy task given group size, SHOP exchanges and self-funding variables! Let’s just look at a few provisions that are effective for the plan year beginning on or after 1/1/2014:

We’ve had a lot of employers request a simple, at-a-glance way to see all the PPACA requirements that apply to their business. This is no easy task given group size, SHOP exchanges and self-funding variables! Let’s just look at a few provisions that are effective for the plan year beginning on or after 1/1/2014:

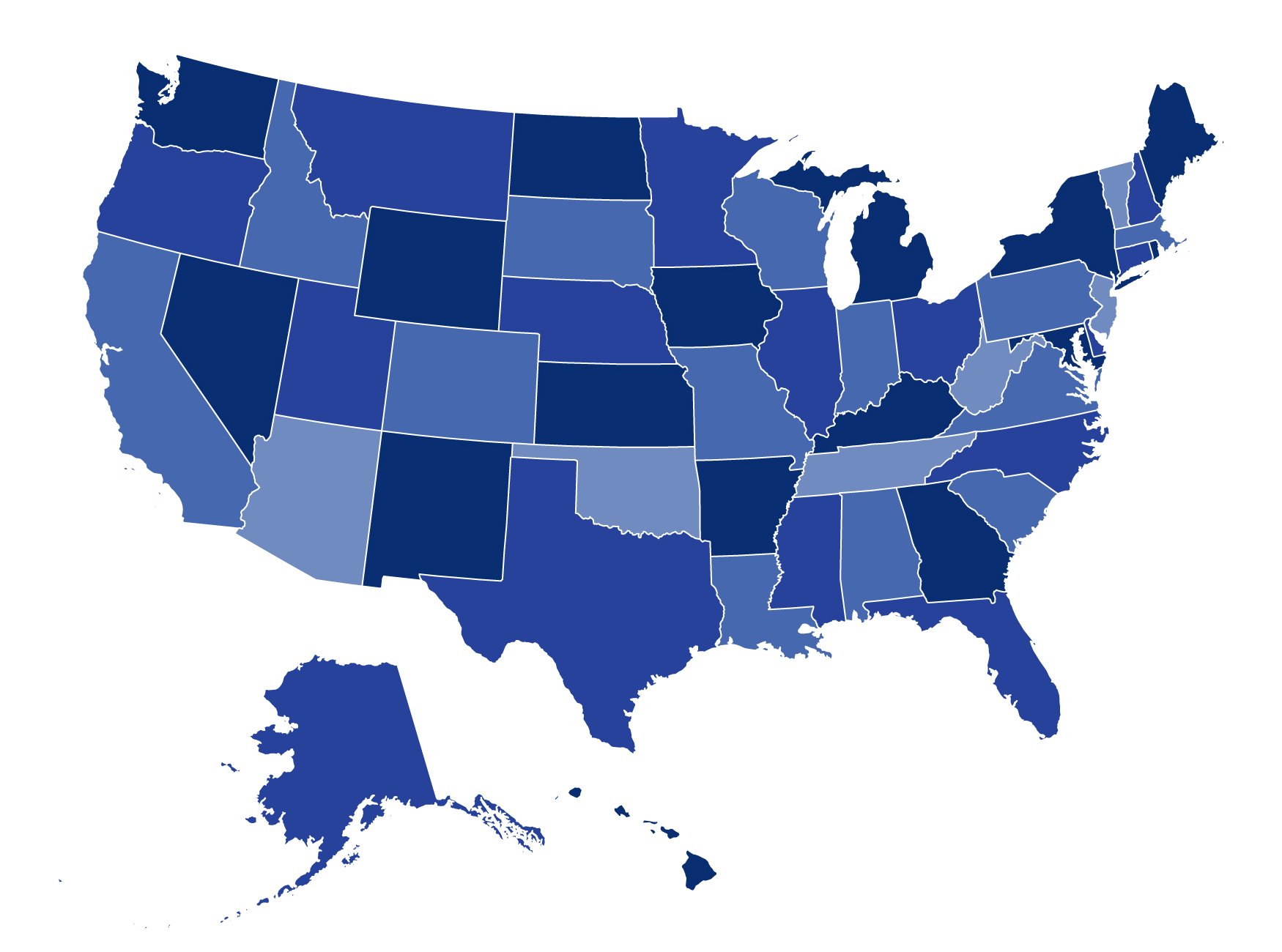

States have two major decisions to make with respect to the Patient Protection and Affordable Care Act (PPACA) – whether they will run the health exchange themselves, and whether they will expand Medicaid to cover most individuals whose income is below 133 percent of the federal poverty level.

States have two major decisions to make with respect to the Patient Protection and Affordable Care Act (PPACA) – whether they will run the health exchange themselves, and whether they will expand Medicaid to cover most individuals whose income is below 133 percent of the federal poverty level.

It’s that time of year for many employers: fall open enrollment! That means many administrators of group health plans (those up for renewal at this time of year) are working to provide Summary of Benefits and Coverage (SBC) to their eligible individuals. (Technically, for insured plans the insurer is responsible for providing an SBC to the employer within seven days after the employer completes an application. The insurer and the plan administrator are each responsible for providing the SBC to participants, but only one of them needs to actually do it – they need to work out who will do the distribution. For self-funded plans, the plan administrator is responsible for providing the SBC. The plan administrator can hire others, like its TPA, to help, but the plan administrator is ultimately responsible.) Assuming you have determined who is responsible, it is a good time to review all the latest requirements (including those independent of renewal dates) to be sure you fulfill this obligation correctly and avoid penalties. SBCs must be provided:

It’s that time of year for many employers: fall open enrollment! That means many administrators of group health plans (those up for renewal at this time of year) are working to provide Summary of Benefits and Coverage (SBC) to their eligible individuals. (Technically, for insured plans the insurer is responsible for providing an SBC to the employer within seven days after the employer completes an application. The insurer and the plan administrator are each responsible for providing the SBC to participants, but only one of them needs to actually do it – they need to work out who will do the distribution. For self-funded plans, the plan administrator is responsible for providing the SBC. The plan administrator can hire others, like its TPA, to help, but the plan administrator is ultimately responsible.) Assuming you have determined who is responsible, it is a good time to review all the latest requirements (including those independent of renewal dates) to be sure you fulfill this obligation correctly and avoid penalties. SBCs must be provided: