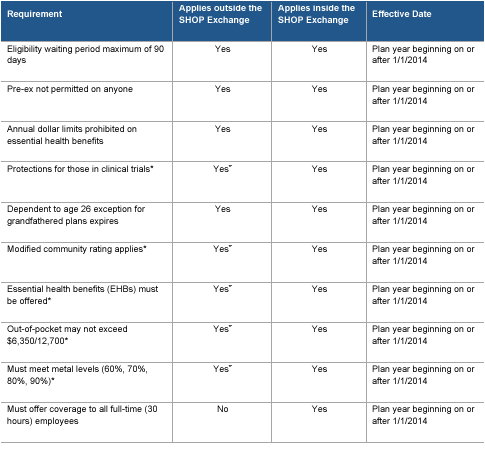

PPACA brings numerous responsibilities and options to employers. Below is a summary of the PPACA provisions that apply to group health plans and whether the provision applies to insured small group plans (50 or fewer employees) provided inside and outside the SHOP exchange.

Provisions Effective 2014 or Later

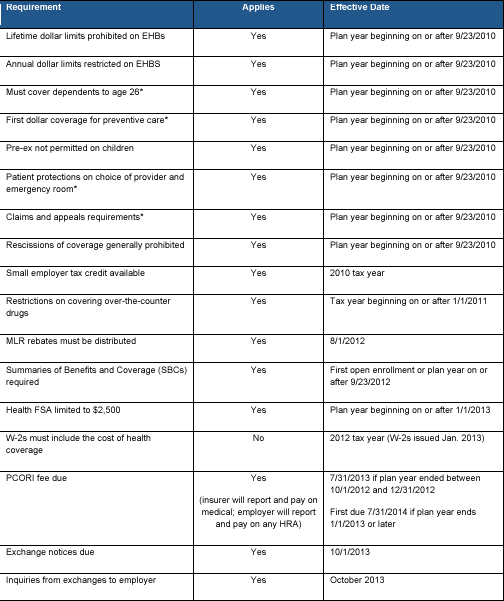

Provisions Effective 2010 – 2013

Provisions Effective 2010 – 2013

United Benefit Advisors has created reference charts that summarize the PPACA requirements applicable to employers of all types. These new resources cover more than 40 PPACA provisions such as FSA limits, W2 reporting, PCORI fees, exchange notices, eligibility waiting periods, modified community rating, deductible and out of pocket limits, wellness rules, IRS reporting, penalties, cadillac tax and more. View the right tool for you at:

http://www.ubabenefits.com/Wisdom/ComplianceSolution/GroupHealthPlansandPPACA/tabid/351/Default.aspx

* Does not apply in whole or part to grandfathered plans; with respect to guaranteed access, open enrollment will be available both inside and outside the exchange each Nov. 15 – Dec. 15 for employers that cannot meet participation requirements for initial issue.

# States have the option to renew policies that do not meet all of the PPACA requirements through Oct. 1, 2016. If renewal of “non-compliant” policies is allowed, this requirement will not apply to those renewed policies.

Note: For 2014 and 2015 a group is considered “small” for the insurance market requirements of PPACA if the group has 50 or fewer employees. Beginning in 2016, a group will be considered “small” for the insurance market requirements if the group has 100 or fewer employees. (In most states part-time employees count pro rata toward full-time equivalent employees using the same method as the employer shared responsibility/play or pay requirement.)

In contrast, for purposes of the employer shared responsibility/play or pay requirement, for 2015 an employer generally will not be considered “large” unless it has 100 or more full-time or full-time equivalent employees. Beginning in 2016, an employer will not be considered “large” for purposes of the employer shared responsibility/play or pay requirement unless it has 50 or more full-time or full-time equivalent employees.