Instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C were released, as were the forms for 1094-B, 1095-B, 1094-C, and 1095-C.

Instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C were released, as were the forms for 1094-B, 1095-B, 1094-C, and 1095-C.

Reporting will be due early in 2018, based on coverage in 2017. For calendar year 2017, Forms 1094-C, 1095-C, 1094-B, and 1095-B must be filed by February 28, 2018, or April 2, 2018, if filing electronically. Statements to employees must be furnished by January 31, 2018. In late 2016, a filing deadline was provided for forms due in early 2017, however it is unknown if that extension will be provided for forms due in early 2018. Until employers are told otherwise, they should plan on meeting the current deadlines.

All reporting will be for the 2017 calendar year, even for non-calendar year plans.

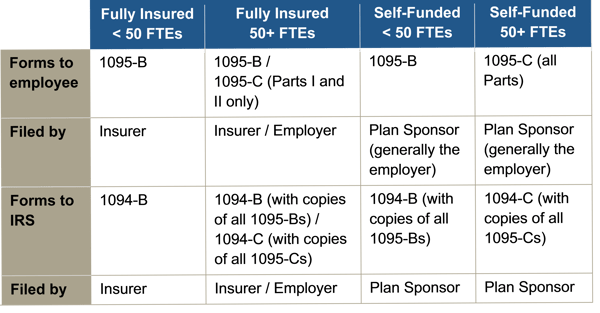

The reporting requirements are in Sections 6055 and 6056 of the ACA. The major reporting requirements are:

By Danielle Capilla

Originally posted by www.UBABenefits.com