On September 30, 2021, the Department of Health and Human Services, the Department of Labor, and the Department of the Treasury (collectively, the Departments), along with the Office of Personnel Management (OPM), released an interim final rule (IFR) under the No Surprises Act (Act) to help protect health care consumers from surprise billing and excessive cost sharing. The IFR primarily explains the Act’s mandatory independent dispute resolution (IDR) process.

Background

A prior interim final rule established that, for emergency services and certain non-emergency services furnished by out-of-network (OON) providers at in-network facilities, patients will pay a cost-sharing rate similar to the in-network rate, which must be calculated based on a state All-Payer Model Agreement, specific state law, or, if neither apply, the qualifying payment amount (QPA). The QPA is generally the plan or carrier’s median contracted rate for the same or similar service in the specific geographic area.

The Act provides that the balance of the bill to be paid by the plan or carrier following patient cost sharing and any initial payment from the plan or carrier is determined between the provider (including air ambulance provider), facility, and the plan or carrier through an open negotiation period. If the parties cannot agree on a payment amount, the Act mandates a federal IDR process.

The IDR process applies only to:

- Balance billing for emergency services; cost-sharing for emergency services must be determined on an in-network basis.

- Patient copayments, co-insurance, or deductibles for emergency services and certain non-emergency services provided at an in-network facility; cannot be higher than if such services were provided by an in-network provider, and any cost-sharing obligation must be based on in-network provider rates.

- OON charges for items or services provided by an OON provider at an in-network facility; prohibited unless notice and consent given in advance. Providers and facilities must provide patients with a plain-language consumer notice explaining that patient consent is required to receive care on an OON basis before that provider can bill the patient more than in-network cost-sharing rates.

Independent Dispute Resolution

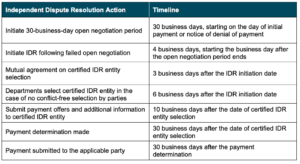

Before initiating the IDR process, disputing parties must initiate a 30-day open negotiation period. If open negotiation fails, either party may start the IDR process. If the parties cannot agree on a jointly selected certified IDR entity, or if the jointly selected certified IDR entity has a conflict of interest, the Departments will select a certified IDR entity. The parties will submit their payment offers along with supporting documentation, and the certified IDR entity will issue a binding determination by selecting one party’s offer.

When making a payment determination, certified IDR entities must assume that the QPA is the appropriate OON amount. The certified IDR entity must consider any credible permissible information submitted by a party. For the IDR entity to deviate from the offer closest to the QPA, however, any information submitted must clearly demonstrate that the value of the item or service is materially different from the QPA.

The IDR process will proceed according to the following guidelines:

Expanded External Review

Additionally, the IFR expands the scope of adverse benefit determinations eligible for external review to include determinations that involve whether a plan or issuer is complying with the surprise billing and cost-sharing protections under the No Surprises Act and its implementing regulations. In addition, under these interim final rules, grandfathered plans that are not otherwise subject to external review requirements will be subject to external review requirements for coverage decisions that involve whether a plan or issuer is complying with the surprise billing and cost-sharing protections under the No Surprises Act.

Conclusion

The regulations in the IFR become applicable to group health plans for plan and policy years beginning on or after January 1, 2022. However, the IFR is subject to a public comment period that will close in December 2021. We will continue to monitor this and other related developments under the No Surprises Act and provide ongoing updates as needed.

©2021 United Benefit Advisors, LLC. All rights reserved.