Across most industries, HSA contributions are, for the most part, down or unchanged from three years ago, according to UBA’s Health Plan Survey. The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). Government and education employers are the only industries with average single contributions well above average and on the rise.

Across most industries, HSA contributions are, for the most part, down or unchanged from three years ago, according to UBA’s Health Plan Survey. The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). Government and education employers are the only industries with average single contributions well above average and on the rise.

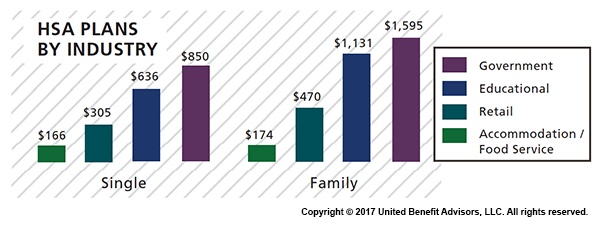

Government employees had the most generous contributions for singles at $850, on average, up from $834 in 2015. This industry also has the highest employer contributions for families, on average, at $1,595 (though that is down from 1,636 in 2015). Educational employers are the next most generous, contributing $636, on average, for singles and $1,131 for families.

Singles in the accommodation/food services industries received virtually no support from employers, with average HSA contributions at $166. The same is true for families with HSA plans in the accommodation/food services industries with average family contributions of $174.

Retail employers also remain among the least generous contributors to single and family HSA plans, contributing $305 and $470, respectively. This may be why they have low enrollment in these plans.

The education services industry has seen a 109 percent increase in HSA enrollment since 2013 (aided by employers’ generous contributions), catapulting the industry to the lead in HSA enrollment at 23.8 percent. The professional/scientific/tech and finance/insurance industries follow closely at 23.3 percent and 22.1 percent, respectively.

The mining/oil/gas industry sees the lowest enrollment at 3.8 percent. The retail, hotel, and food industries continue to have some of the lowest enrollment rates despite the prevalence of these plans, indicating that these industries, in particular, may want to increase employee education efforts about these plans and how they work.

For a detailed look at the prevalence and enrollment rates among HSA and HRA plans by group size and region, view UBA’s “Special Report: How Health Savings Accounts Measure Up”.

Benchmarking your health plan with peers of a similar size, industry or geography makes a big difference in determining if your plan is competitive. To compare your exact plan with your peers, request a custom benchmarking report.

For fast facts about HSA and HRA plans, including the best and worst plans, average contributions made by employers, and industry trends, download (no form!) “Fast Facts: HSAs vs. HRAs”.

By Bill Olson

Originally Posted By www.ubabenefits.com