By Thomas Mangan

By Thomas Mangan

CEO, United Benefit Advisors

Paul, who owns a mid-size design firm in Atlanta, Ga., wanted to recruit some new talent and had some questions about how best to highlight the health benefits his firm could offer. In his research, he looked up national averages for single employee health plan cost: the amount the employee contributed to monthly premiums.

When compared against the national average for all plans, an employee at Paul’s firm pays $63 per month less, which he thought was pretty great! However, upon a closer look using more detailed benchmarking data from the 2013 UBA Health Plan Survey, he could see that when compared with other CDHPs in the Southeast region, his employee’s cost is actually $26 per month more expensive than the average.

Taking another approach, however, by comparing his employee’s cost to the closest peers using a state-specific benchmark, which in Georgia is $419, it became clear his employee’s monthly single premium is actually $10 less than competitors in the state.

Subsequently, Paul chose to highlight to potential new employees that their plan was slightly less expensive than the state average, and further emphasized all of the other great voluntary benefits his firm offers – a smart and informed strategic move.

Historically, benchmarking data of this kind were unavailable to small and mid-size employers. Now, by using such detailed information, employers are able to more accurately evaluate costs, and ultimately gain a competitive edge in recruiting and retaining a superior workforce.

Download a copy of the 2013 UBA Health Plan Survey Executive Summary or request a customized benchmarking report from a UBA Partner Firm.

Mike Humphrey

Mike Humphrey

Sr. Benefit Advisor

The Wilson Agency, a UBA Partner Firm

The Affordable Care Act (ACA) has so many provisions to be aware of that it can be downright overwhelming. Here are the top three, often overlooked, strategies to help your company get ready for the changes to come.

Certainly there is a lot more to consider and know regarding the compliance, management, administration and strategy of health care reform. Unless you’re a large company with dedicated benefit professionals, you probably don’t have the staff or the time to dedicate to these new regulations. Lean on your benefit advisor for guidance on other strategies you can use as you prepare for 2014 and beyond.

We’ve had a lot of employers request a simple, at-a-glance way to see all the PPACA requirements that apply to their business. This is no easy task given group size, SHOP exchanges and self-funding variables! Let’s just look at a few provisions that are effective for the plan year beginning on or after 1/1/2014:

We’ve had a lot of employers request a simple, at-a-glance way to see all the PPACA requirements that apply to their business. This is no easy task given group size, SHOP exchanges and self-funding variables! Let’s just look at a few provisions that are effective for the plan year beginning on or after 1/1/2014:

Here’s what (non-grandfathered) large group insured plans (more than 50 employees) should be focused on:

For an at-a glance chart of over 40 PPACA requirements, whether they apply to large groups and their respective effective dates, request Large Group Insured Plans (More Than 50 Employees) and PPACA.

If you are a (non-grandfathered) small group (50 or fewer employees) insured plan, keep a watch on the following requirements that apply BOTH inside and outside the SHOP exchange:

For an at-a glance chart of over 40 PPACA requirements, whether they apply to small insured plans outside and/or inside the SHOP exchange and their respective effective dates, request Small Group Insured Plans (50 or Fewer Employees) and PPACA

If you are a small OR large self-funded plan, the following requirements should be on your radar:

For more information on over 40 PPACA requirements, whether they apply to small and/or large insured group self-funded plans and their respective effective dates, request Self-funded Plans and PPACA.

Results from the United Benefit Advisors (UBA) 2013 Health Plan Survey are in! See how your firm’s health plan stacks up against your competitors.

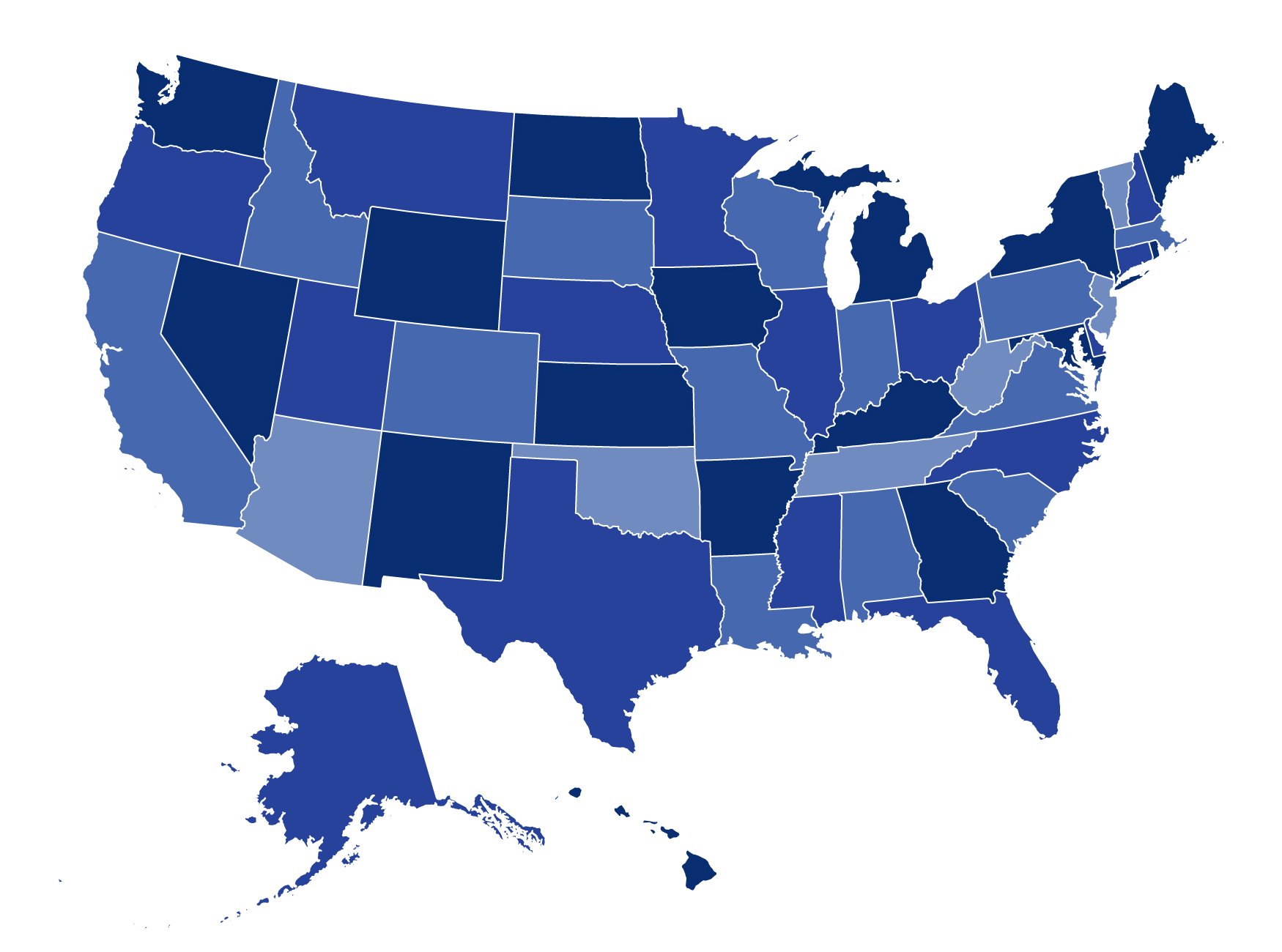

States have two major decisions to make with respect to the Patient Protection and Affordable Care Act (PPACA) – whether they will run the health exchange themselves, and whether they will expand Medicaid to cover most individuals whose income is below 133 percent of the federal poverty level.

States have two major decisions to make with respect to the Patient Protection and Affordable Care Act (PPACA) – whether they will run the health exchange themselves, and whether they will expand Medicaid to cover most individuals whose income is below 133 percent of the federal poverty level.

Do you know where your state stands, and what your options are? If not, read on…

Exchange Election

Beginning in 2014, all states will have a health exchange (also known as the health marketplace). If a state chooses not to run an exchange, the federal government will run the exchange for the state. An exchange run by the federal government for a state is called a federally facilitated exchange (FFE). States may also choose to share the operation of an exchange with the federal government – that is called a partnership exchange. (For more information about the exchanges see our PPACA Advisor Appendix on Exchange Election.)

Medicaid Election

States also have to decide whether they will expand Medicaid coverage to most individuals who have an income below 133 percent of the federal poverty level (FPL). The FPL is $11,490 for a single person and $23,550 for a family of four in 2013. The federal government will pay most of the cost of expanded Medicaid coverage, but some states have concerns about the ultimate cost of the expansion to the states. (For more information about Medicaid and PPACA, see our PPACA Advisor Appendix on Medicaid Election.)

To see where your state stands on exchanges and medicaid, click here for a free chart of state status as of September 17, 2013.

As millions of working Americans open their employer’s health care packets this month, many will be encountering a new option: high-deductible plans linked to health savings accounts that come loaded with tax benefits.

Citrix (the makers of GoToMeeting and GoToWebinar) has completed an upgrade for all UBA users of this product.

By Linda RowingsChief Compliance OfficerUnited Benefit Advisors

With the advent of the health marketplaces, why do we still have COBRA?

The framers of PPACA decided that COBRA should be available even after the health marketplaces become available prim…

It’s that time of year for many employers: fall open enrollment! That means many administrators of group health plans (those up for renewal at this time of year) are working to provide Summary of Benefits and Coverage (SBC) to their eligible individuals. (Technically, for insured plans the insurer is responsible for providing an SBC to the employer within seven days after the employer completes an application. The insurer and the plan administrator are each responsible for providing the SBC to participants, but only one of them needs to actually do it – they need to work out who will do the distribution. For self-funded plans, the plan administrator is responsible for providing the SBC. The plan administrator can hire others, like its TPA, to help, but the plan administrator is ultimately responsible.) Assuming you have determined who is responsible, it is a good time to review all the latest requirements (including those independent of renewal dates) to be sure you fulfill this obligation correctly and avoid penalties. SBCs must be provided:

It’s that time of year for many employers: fall open enrollment! That means many administrators of group health plans (those up for renewal at this time of year) are working to provide Summary of Benefits and Coverage (SBC) to their eligible individuals. (Technically, for insured plans the insurer is responsible for providing an SBC to the employer within seven days after the employer completes an application. The insurer and the plan administrator are each responsible for providing the SBC to participants, but only one of them needs to actually do it – they need to work out who will do the distribution. For self-funded plans, the plan administrator is responsible for providing the SBC. The plan administrator can hire others, like its TPA, to help, but the plan administrator is ultimately responsible.) Assuming you have determined who is responsible, it is a good time to review all the latest requirements (including those independent of renewal dates) to be sure you fulfill this obligation correctly and avoid penalties. SBCs must be provided:

While the obligation to issue an SBC applies to all employers, regardless of size or type (private, government, not-for-profit)—including grandfathered plans—it primarily covers medical (PPO, HDHP, HMO, etc.) coverage and is not needed for the following:

Remember that you must use the standard format prescribed by the regulatory agencies for the SBC. UBA offers a highlights document with a great summary of what and what not to include, alternate language requirements, electronic delivery guidelines and more. Make sure you:

If you aren’t sure how to handle vision benefits, HRAs, EAP, wellness programs, HSAs, FSAs, carve-outs, information on premiums/contributions or how to complete the coverage examples or reconcile your plan terms with the glossary, view the UBA SBC Frequently Asked Questions document for detailed information.

So why does this process seem so inflexible? The purpose of the SBC is to make it easier for employees to compare coverage options. The regulatory agencies believe that consistent presentation will make it easier for employees to do side-by-side comparisons. We hope these latest UBA tools (SBC highlights and SBC Frequently Asked Questions) help make this process more bearable!

By Josie Martinez, Senior Partner and Legal Counsel

By Josie Martinez, Senior Partner and Legal Counsel

EBS Capstone, A UBA Partner Firm

It is becoming more and more common for employers to offer wellness incentives to their employees as motivation for employees to improve their overall health and well-being. Management has started to buy in to the fact that there is a correlation between healthier employees, lower medical claims and lower medical premiums, but this only works with employee participation. While an effective means to incentivize employees to do something positive about their health, however, there are tax implications to these incentives that are often overlooked and/or misunderstood by both employers and employees.

Wellness incentives can range from nominal in nature to more significant financial rewards. Employers may offer gift cards or cash, partial or total gym reimbursements, raffles or prizes, free T-shirts, sneakers or even tickets to a sporting event or show. Incentives can also include such things as reductions in employee premiums or contributions and employer contributions to HSAs, HRAs, FSAs, etc. The bottom line is that incentives can come in all forms, shapes and amounts. The issue is how are these incentives treated for tax purposes?

Many types of incentive awards are treated as taxable wages and subject to payroll taxes. Exclusions may apply to amounts provided to employees for “medical care” but expenses that are simply for the benefit of a person’s general health or well-being are not expenses for “medical care” and therefore taxable. The general IRS rule states that any award or prize given by an employer is taxable to an employee as wages, to be included on their W-2 and subject to Federal tax withholdings, as well as Social Security and Medicare taxes unless a tax exemption is explicitly described in the tax code. The most commonly used incentive award that is exempted from taxation in the code is employer contributions to a health plan. So where the wellness program includes an employer reward in the form of lower employee contribution for the health plan, or an employer-funded HRA, these employer paid rewards are tax exempt.

Another exception to the general rule is the “de minimus award” rule. The value of any property or services provided to an employee that has so little value that accounting for it would be unreasonable or administratively impracticable is not included in employee compensation and is not taxable because it is considered de minimus. The IRS states that a de minimis award is one of nominal value and is provided infrequently. Unfortunately, there is no bright-line dollar amount as to what qualifies. A safe bet is probably somewhere between $25 and $100, but not $100 every three months. Again, little guidance is present so employers must use their judgment in deciding whether a particular item is excludable from employee income as a de minimis fringe benefit. Some employers therefore assume that a gift card in a nominal amount should not be taxable to the employee, but cash is always taxable, regardless of the amount, regardless of the reason and regardless of the frequency. If you want to give cash, it is best paid through payroll as wage-related earnings. Gift cards or certificates are considered cash equivalents and therefore treated the same as cash.

A creative incentive is when employers award additional paid time off or permit employees to exercise or attend health classes during work hours. Any wages (i.e., cash) paid with respect to additional “free time” continue to be taxable to the employee and subject to payroll taxes. Finally, the fact that an employer may have a third party to run the wellness program and/or is the one distributing the incentives does not change the rules because ultimately, the third party is really the employer’s agent.

So, while wellness incentives are an effective tool to engage employees about their health, employers must remember that, if they offer taxable wellness incentives, they must report these rewards on the employee’s Form W-2 and withhold appropriate taxes on these amounts.